extended child tax credit 2022

Children draw on top of a canceled check prop during a rally in front of the US. 1 2022 the child tax credit reverted to what it was originally.

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

How Expansion Could Eliminate Poverty for Millions.

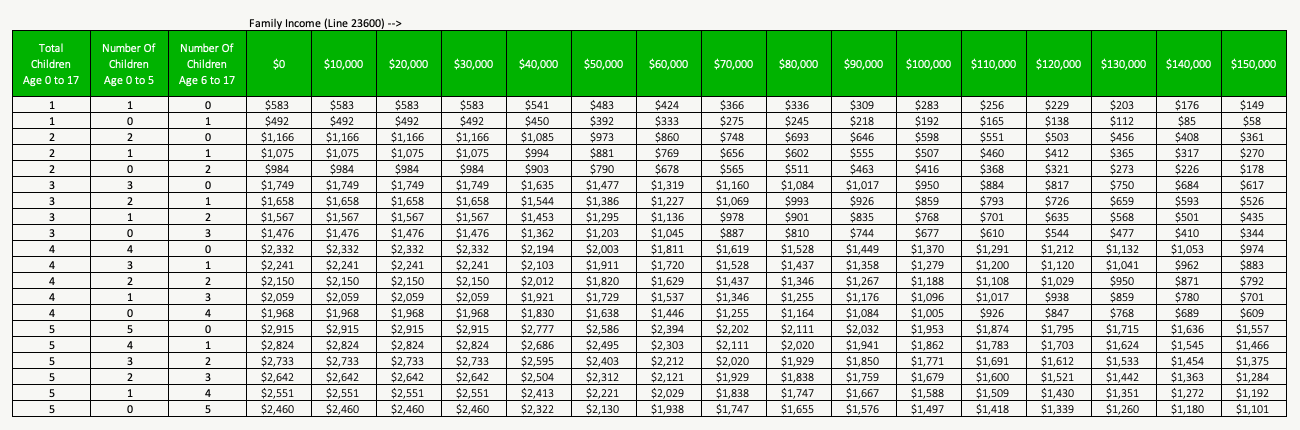

. Alina Demidenko Getty ImagesiStockphoto. For children under 6 the amount jumped to 3600. The legislation made the existing 2000 credit per child more generous with up to 3600 per child under age 6 and 3000 per child ages 6 through 17.

First its worth only 2000 per qualifying child. They can apply for extended credit and receive more money when they file their taxes. We will have Child Tax Credit in 2022 to help working families with income covered by the program.

While not everyone took advantage of the payments which started in July 2021 and ended in. New research shows a permanently expanded child tax credit. The recent expansion of this credit means that more people may qualify to have some much-needed money put back in their pocket.

For 2022 the tax credit returns to its previous form. Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. You are eligible for the Child Tax Credit if.

Last year the souped-up version delivered 3000 for children ages 6 and up and 3600 for younger children. In 2021 President Joe Biden. April 19 2022 956 AM 2 min read.

Eligible families are those who meet the requirements. Last year the tax credit was also fully refundable meaning. Alternatively some families have chosen to waive monthly payments in favor.

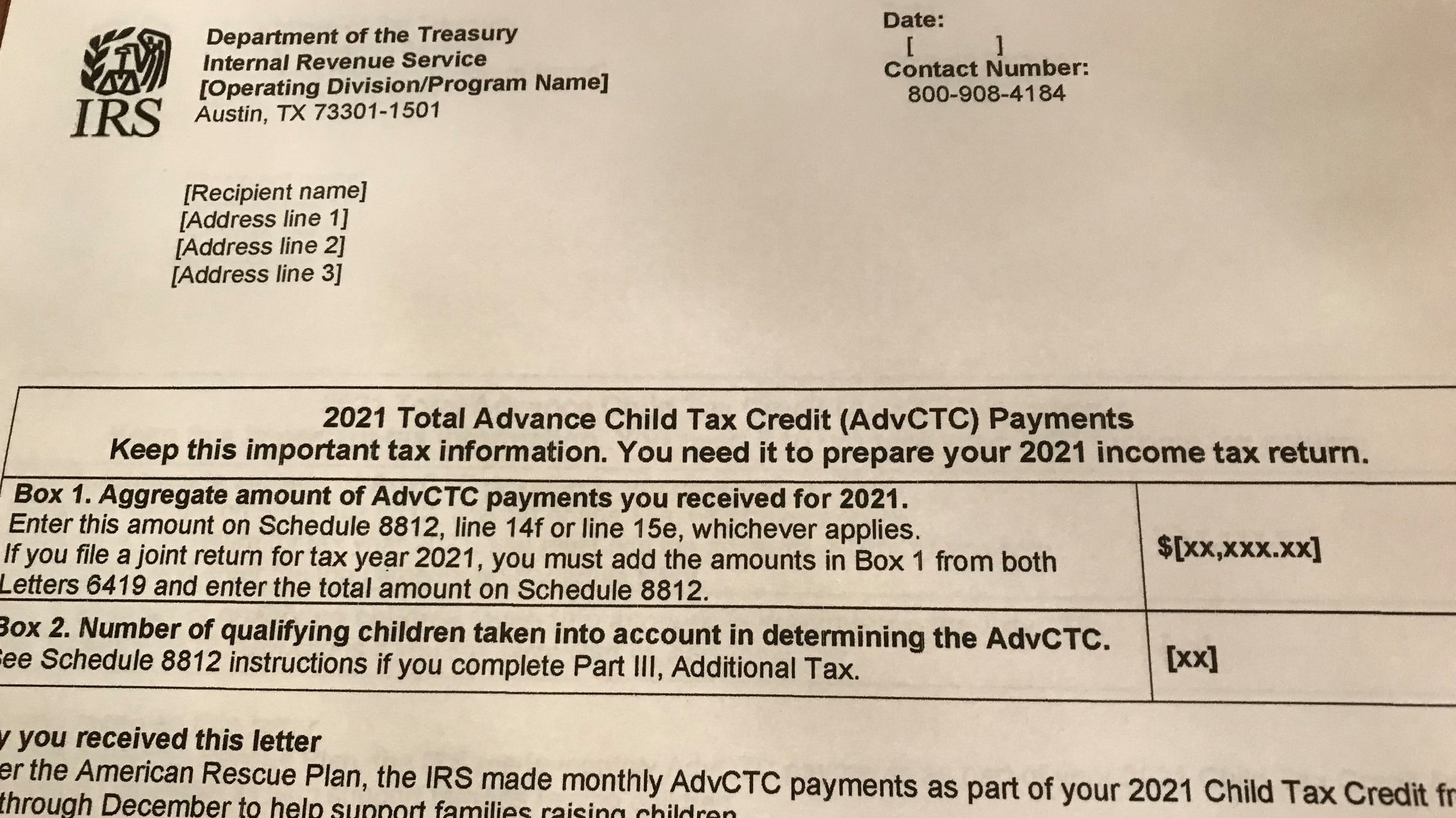

This credit is also not being paid in advance as it was in 2021. After the passage of the American Rescue Plan Act in 2021 the current Child Tax Credit CTC was increased to 3000 for children under the age of 18 and 3600 for children under the age of six. It hasnt been extended through 2021 and as of Jan.

WASHINGTON DC - DECEMBER 13. Now if the current payment amounts do not pass in Congress moving forward eligible parents can only receive a once-a-year maximum credit per child come tax time -- 1000 for. This means that the credit will revert to the previous amounts of 2000 per child.

According to the Tax Policy Center the price of reverting to the old child tax credit for 2022 would be about 1255 billion whereas the more generous benefit of. For parents who opted out of the advanced child tax credit payments in 2021 they will be able to claim the full credit if they qualify on their 2021 tax return. In the meantime the expanded child tax credit and advance monthly payments system have expired.

For 2022 that amount reverted to 2000 per child dependent 16 and younger. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit.

Thus 3600 was offered for a child under the age of six and 3000 for children between the ages of six and 17. Capitol on December 13. 2022 Child Tax Credit.

The American Rescue Plan was passed in Congress in 2021 with this increasing the amount that eligible American families could receive from their Child Tax Credit payments. 660 Stimulus Check Deadline Is Near 1100 Boost Now Deposited. Moreover in the second half of 2021 it became possible to obtain Child tax credit monthly payments before receiving the other half as a lump sum after tax returns are filed in 2022.

This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17. Following the failure of President Joe Bidens Build Back Better strategy in Congress earlier in 2022 ten states are giving financial assistance to families. That means that when parents claim the tax credit on their returns next year the benefit.

2000 per child in the form of a tax refund instead of monthly payments. Prior to 2021 the Child Tax Credit maxed out at 2000 per child and was only partially refundable. That meant if a household claiming the credit owed the IRS no money it couldnt collect its.

You are single and your income is less than 75000. The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan. Enhanced Child Tax Credit Will Revert to Original 2000 for 2022.

COVID Tax Tip 2022-31 February 28 2022 The EITC is one of the federal governments largest refundable tax credits for low-to moderate-income families. Here is what you need to know about the future of the child tax credit in 2022. As such there was.

As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous 2000. January 31 2022 830 AM 3 min read.

Child Tax Credit Reduced Usage Of High Cost Financial Services The Source Washington University In St Louis

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit 2022 Could You Get 450 Per Child From Your State Cnet

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Free Tax Information In 2022 Tax Software Estimated Tax Payments Filing Taxes

The 2022 Tax Deadlines In 2022 Tax Deadline Tax Filing Taxes

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax

Taxes 2022 What Families Should Know About The Child Tax Credit Youtube

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit Will There Be Another Check In April 2022 Marca

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Filing Taxes

Federal Solar Tax Credit Extended Residential Solar Tax Credits Solar

The Advance Child Tax Credit 2022 And Beyond

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities